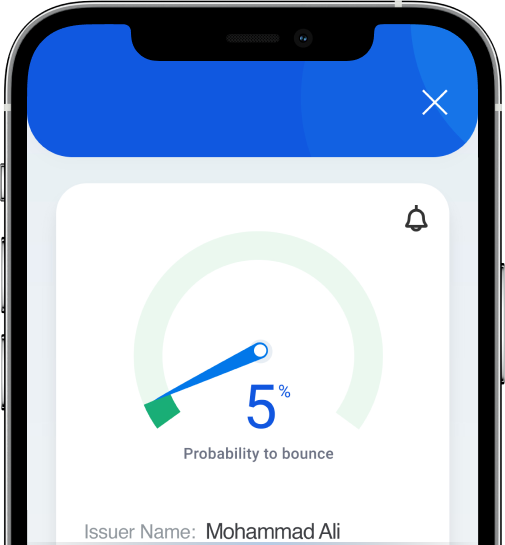

How is the Cheque Score Calculated?

The Cheque Score is calculated using a complex algorithm based on modern predictive analytics methodologies taking into account not only cheques, but also the vast information available in the credit profile of Etihad Credit Bureau database and compares it to the information available for all other cheques issued in credit history and behavior of individuals or companies in the UAE.

Your payments history contributes to your financial footprint and there are certain financial behaviors that can help in improving your Cheque Score:

- Making payments on or before the due date.

- Reducing the number of credit cards and loans.

- Avoiding bouncing cheques.

- Reducing outstanding balances and credit card limit utilization.

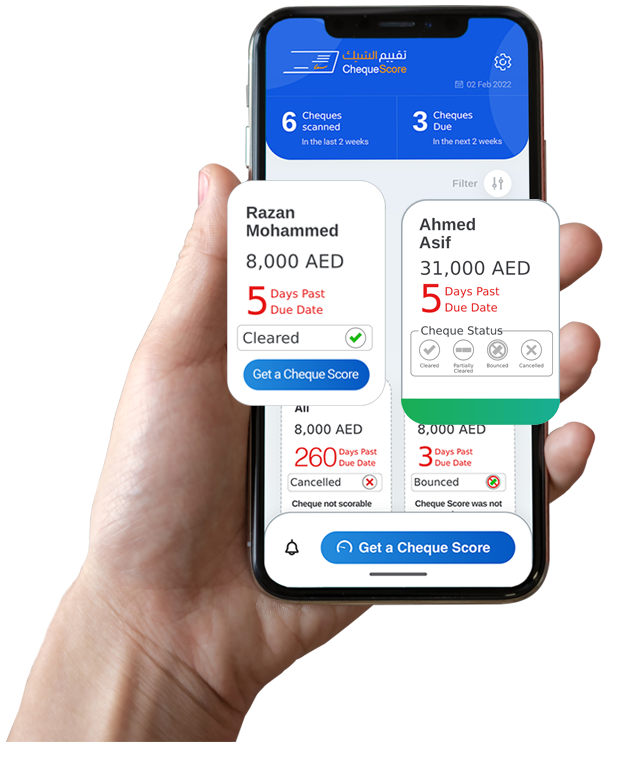

Benefits for the cheque receiver

ChequeScore gives you the much-needed peace of mind. Because knowing the possibility of a cheque to bounce is something ChequeScore can provide upfront. Helping you, the receiver, to take a more informed decision on whether to accept or not a cheque as a method of payment.

ChequeScore is decidedly valuable to Small and Medium Enterprises (SMEs), offering a simple solution to maintain stable cashflow and avoid uncertainty.

Get a Cheque Score now

For an optimal experience, please rotate your device to portrait mode.

For an optimal experience, please rotate your device to portrait mode.